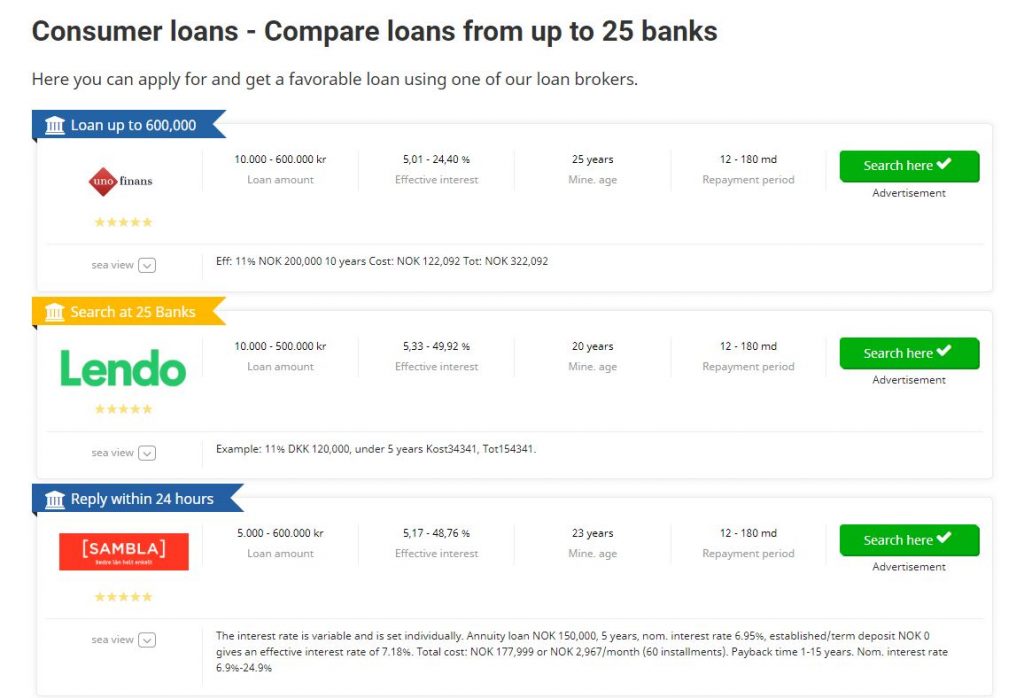

A consumer loan is a type of borrowing that lets you purchase items or services that are far beyond your annual earnings. These loans can be used to finance a variety of needs, including major purchases such as buying a home or car. Read the information provided to you on slik går du frem for å søke forbrukslån.

The most common types of consumer loans include mortgages, auto loans, education loans and personal loans. The terms, interest rates and repayment options vary depending on the purpose of the loan and the borrower’s financial situation.

Consumer loans are typically unsecured, meaning there is no collateral backing the debt. This means if the borrower defaults on their payments, the lender can’t repossess or sell anything to recover the funds. This makes these loans more risky for lenders, who charge a higher interest rate and require larger down payments to secure the loan.

Unsecured debt is harder for borrowers to pay off because it has no collateral to fall back on. This can lead to additional interest charges and late fees if you don’t repay the balance in full by the due date.

Credit cards are a popular form of unsecured debt. These cards typically bill once a month and charge interest on any amount that remains unpaid.

Some people use credit cards to make everyday purchases, such as groceries or gas. This can help them manage their spending by spreading purchases out over time and building payment into their monthly budgets.

Another reason people use consumer loans is to pay for big purchases that would otherwise cut too deeply into their cash reserves or budgets. These purchases can be essential for achieving a wide range of life goals, from purchasing a house to improving your health.

One of the primary benefits of these types of loans is their ability to spread out purchases over time, which can save you money on interest. This can also help you build up a rainy day fund and a cash reserve for other needs.

BBVA Compass offers many different kinds of consumer loans, from credit cards to home equity loans. We can help you find the best fit for your needs and budget.

There are two main types of consumer loans: secured and unsecured. Each has its own set of rules, but most rely on the same basic principles.

Secured loans are backed by the borrower’s assets, such as their home or car. This helps protect the bank from losing the loan if the borrower defaults on their debt.

Lenders may offer a lower interest rate for secured loans because they have the collateral to fall back on, but this can be offset by higher interest costs and additional fees. This is why it’s important to shop around before deciding which loan is best for you.

Unsecured loans are based on the borrower’s credit history and their ability to repay the debt. The credit score of the borrower is a large factor in determining the interest rate they receive, as well as their overall creditworthiness.

Consumer Loans Can Help You Realize Your Dreams

Whether you’re buying a home, a car, or planning a family vacation, a consumer loan can help you realize your dreams.

These types of loans come from banks, credit unions and online lenders, as well as friends or family members. They allow you to finance your purchases and financial goals, while keeping your cash reserves intact.

When you borrow money, the lender determines your loan terms by assessing your creditworthiness. They will offer you competitive rates based on your credit score and other factors.

However, if you have poor credit, you may be turned down for a loan. In addition, you might need to pay a higher interest rate than someone with excellent credit.

Secured loans are backed by collateral, such as a home or a car. This ensures that the lender is covered if you default on your loan.

Unsecured loans don’t have any collateral, so the lender has less security to back the loan and will charge you a higher interest rate.

The most common examples of unsecured loans are credit cards and personal loans.

In addition, many banks and credit unions now offer revolving or open-end credit lines for consumers. These lines of credit can be used for any purchase, and are often revolving.

While revolving and open-end lines of credit can be very helpful, you should consider your financial situation carefully before deciding on one or the other. You’ll want to make sure you can afford the repayment of the loan and that it is compatible with your monthly budget.

Borrowers should also be aware of how much they can borrow and the maximum amount they can spend before incurring penalties or fees. These can be a significant financial burden, so it’s important to understand the limits before applying for a loan.

Revolving credit can be a very helpful tool when you need to borrow money quickly and easily. It can be a great way to make purchases and then pay off the debt later, avoiding penalties or high interest charges.

Credit card use is a popular form of revolving credit and can be a great way to build your credit history. It’s important to know that your use of this type of credit can affect your credit score, so it’s best to pay off your balance in full every month.

When you use revolving credit, you can build your credit quickly and easily, as the interest rates are typically lower than those for other types of loans. If you are a new consumer or are reestablishing your credit, you should be aware that the interest rates for these types of loans can be high.

In most cases, revolving credit is best for making large purchases that you can pay off in full, and it’s important to choose the right loan for your needs.

Regardless of which type of loan you decide to take out, it’s important to follow the guidelines set by your state and federal regulators to protect your interests. Those guidelines can include a clear explanation of the length and conditions of your loan and a detailed list of any penalties or fees that might apply if you are late on payments.